- A developer association said it backs China’s proposed national security bill for Hong Kong because it will guarantee stability and prosperity

- The families behind Swire Pacific, Galaxy Entertainment Group and Jardine Matheson Holdings have issued similar endorsements.

After 12 months of political turmoil, a pandemic and the worst recession on record, Hong Kong’s richest people have emerged with their fortunes intact.

The billionaire class of real estate developers, taipans and conglomerate founders who dominate Hong Kong’s economy are now lining up to support a controversial national security law, siding with the Chinese government despite widespread opposition from local residents and Western leaders.

The nine richest people with companies listed in the city have endorsed the bill, either personally – as was the case with and Michael Kadoorie – or through one of their businesses or relatives. Their fortunes are worth a combined US$140 billion.“Business leaders in Hong Kong have no choice if they do not relocate themselves and their businesses,” said Steve Tsang, director of the China Institute at SOAS University of London. “The passing of the decision on the national security law is a clear warning to them, and if they do not publicly support it, they know they risk being seen as opposing it.”

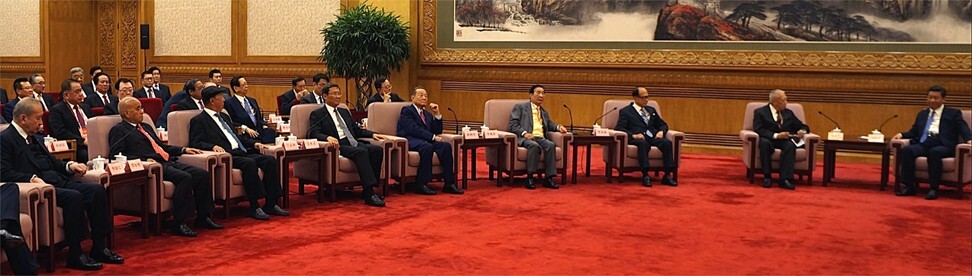

A 70-strong delegation of tycoons, business elites and professionals meet President Xi Jinping in the Great Hall of People on 21 September 2014. The tycoons sitting in the front row include (from left to right) Bank of East Asia chairman David Li Kwok-po; New World Development chairman Henry Cheng Kar-shun; K Wah Group chairman and Galaxy Entertainment Group founder Lui Che-woo; Wharf (Holdings) chairman Peter Woo Kwong-ching; Chairman of Kerry Group, Robert Kuok Hock Nien; Henderson Land Development chairman Lee Shau-kee; Cheung Kong (Holdings) chairman Li Ka-shing; and Tung Chee-hwa, a vice-chairman of CPPCC . Photo: HandoutA developer association representing firms including and the Kwok family’s Sun Hung Kai Properties said it backs the law because it will guarantee stability and prosperity. The families behind , Galaxy Entertainment Group and have issued similar endorsements.

A 70-strong delegation of tycoons, business elites and professionals meet President Xi Jinping in the Great Hall of People on 21 September 2014. The tycoons sitting in the front row include (from left to right) Bank of East Asia chairman David Li Kwok-po; New World Development chairman Henry Cheng Kar-shun; K Wah Group chairman and Galaxy Entertainment Group founder Lui Che-woo; Wharf (Holdings) chairman Peter Woo Kwong-ching; Chairman of Kerry Group, Robert Kuok Hock Nien; Henderson Land Development chairman Lee Shau-kee; Cheung Kong (Holdings) chairman Li Ka-shing; and Tung Chee-hwa, a vice-chairman of CPPCC . Photo: HandoutA developer association representing firms including and the Kwok family’s Sun Hung Kai Properties said it backs the law because it will guarantee stability and prosperity. The families behind , Galaxy Entertainment Group and have issued similar endorsements.Critics have argued that Beijing’s plan to impose the security bill by sidestepping Hong Kong’s legislature will mark the end of the “one country, two systems” principle that has underpinned the city’s status as a global financial hub.

- One of the law’s staunchest opponents is media tycoon Jimmy Lai, who has called out his fellow moguls for kowtowing to Beijing. Lai was arrested along with others earlier this year as part of a crackdown on pro-democracy figures who supported demonstrations that began last June.

- While those protests kicked off one of the most turbulent 12 months in Hong Kong’s history, the collective fortunes of the city’s richest haven’t suffered. Since the unrest started, their net worth has actually climbed 0.7 per cent, according to the Bloomberg Billionaires Index. That compares with an 8.1 per cent slide in the benchmark Hang Seng Index over the same period.One of the law’s staunchest opponents is media tycoon Jimmy Lai, who has called out his fellow moguls for kowtowing to Beijing. Lai was arrested along with others earlier this year as part of a crackdown on pro-democracy figures who supported demonstrations that began last June.While those protests kicked off one of the most turbulent 12 months in Hong Kong’s history, the collective fortunes of the city’s richest haven’t suffered. Since the unrest started, their net worth has actually climbed 0.7 per cent, according to the Bloomberg Billionaires Index. That compares with an 8.1 per cent slide in the benchmark Hang Seng Index over the same period.

No comments:

Post a Comment